Transaction Risk Scoring & Alert Automation

Gain real-time visibility into potentially fraudulent transactions, ensuring faster response, reduced financial loss, and improved risk control.

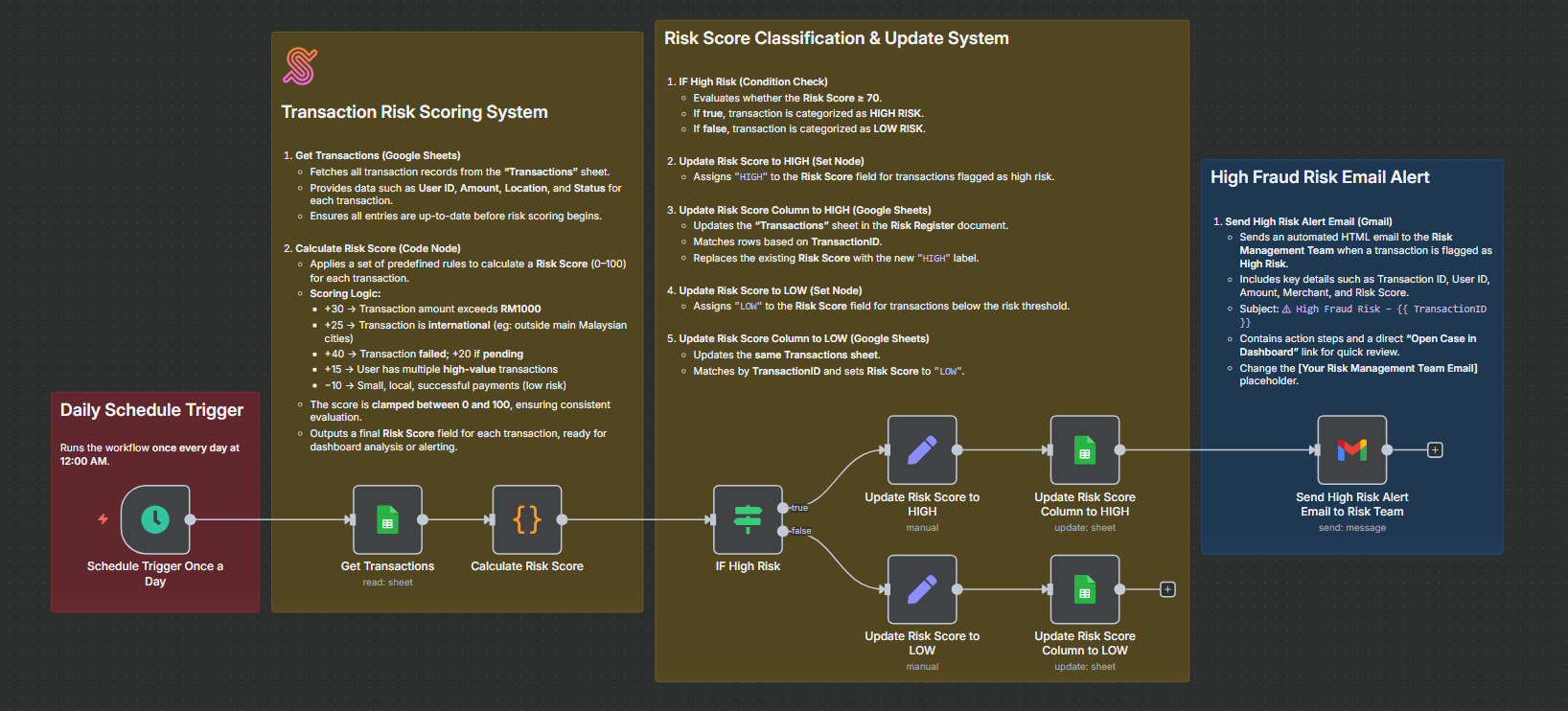

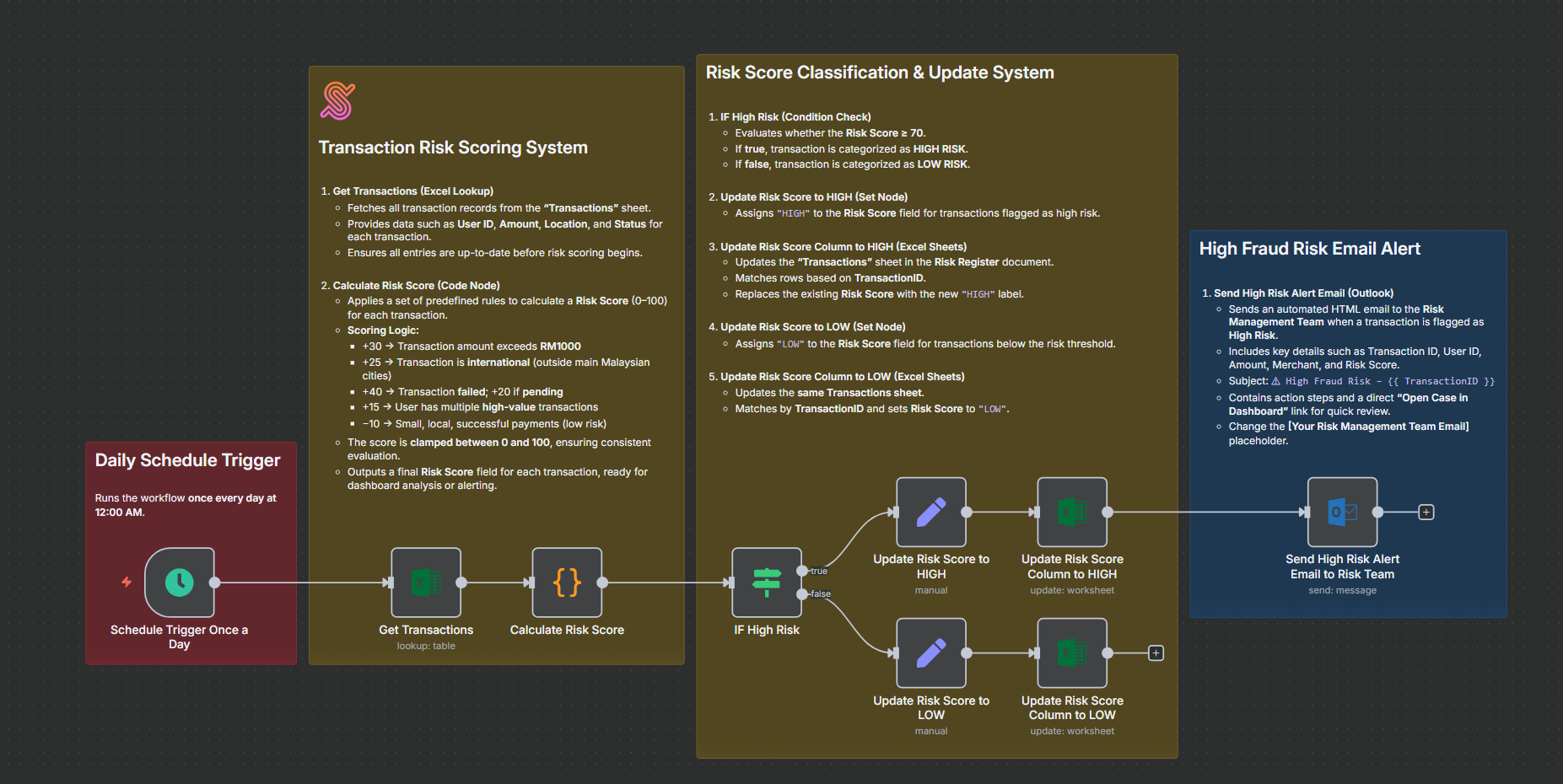

This workflow automatically evaluates daily transactions to detect potential fraud or high-risk activities. It assigns a risk score to each transaction and sends instant alerts to the risk management team when suspicious behavior is detected.

Documentation

Documentation

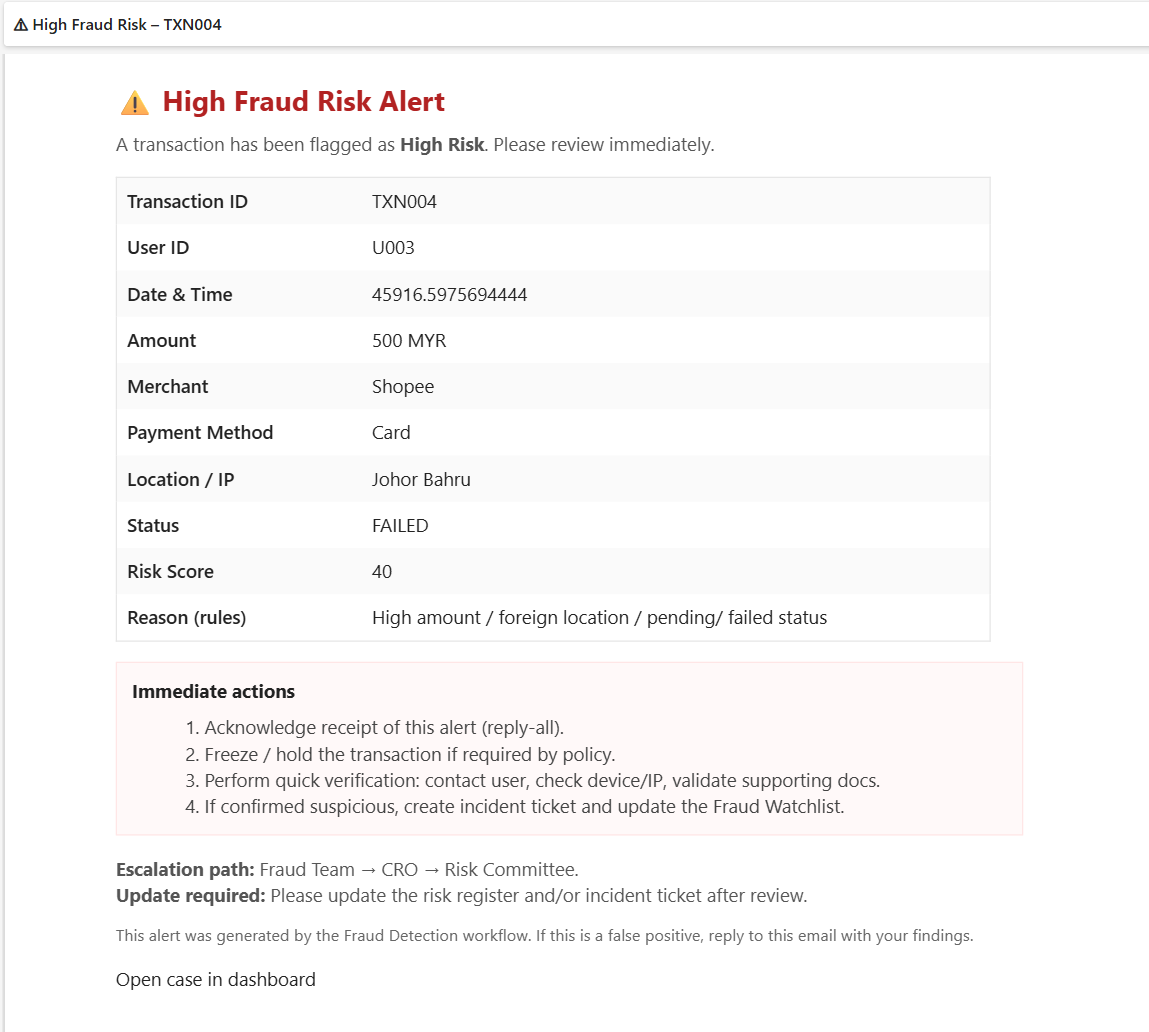

The Transaction Risk Scoring & Alert Automation brings intelligence and efficiency to fraud detection. It scans every transaction daily, evaluates its risk level using defined business rules, and flags those that require immediate review.

By automating risk scoring, updating records, and triggering email alerts, this workflow minimizes manual monitoring effort while maximizing accuracy and response speed. Designed for financial institutions, payment processors, or compliance teams, it ensures critical risk data is delivered directly to decision-makers before issues escalate.

Workflow Steps

- Daily Trigger: The workflow runs automatically once every day at midnight.

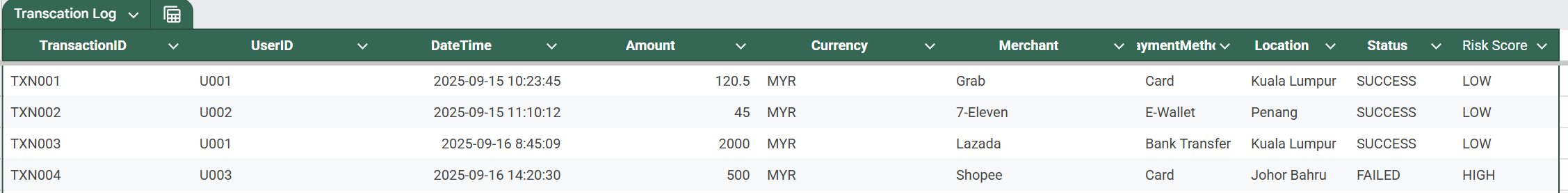

- Retrieve Transactions: It fetches transaction data from a central sheet or database.

- Calculate Risk Score: Each transaction is scored using preset conditions like amount, location, and payment status.

- Categorize Risk:

- Transactions scoring 70 or above are labeled as High Risk.

- Others are marked as Low Risk.

- Update Records: The system updates each transaction’s risk level in the source sheet.

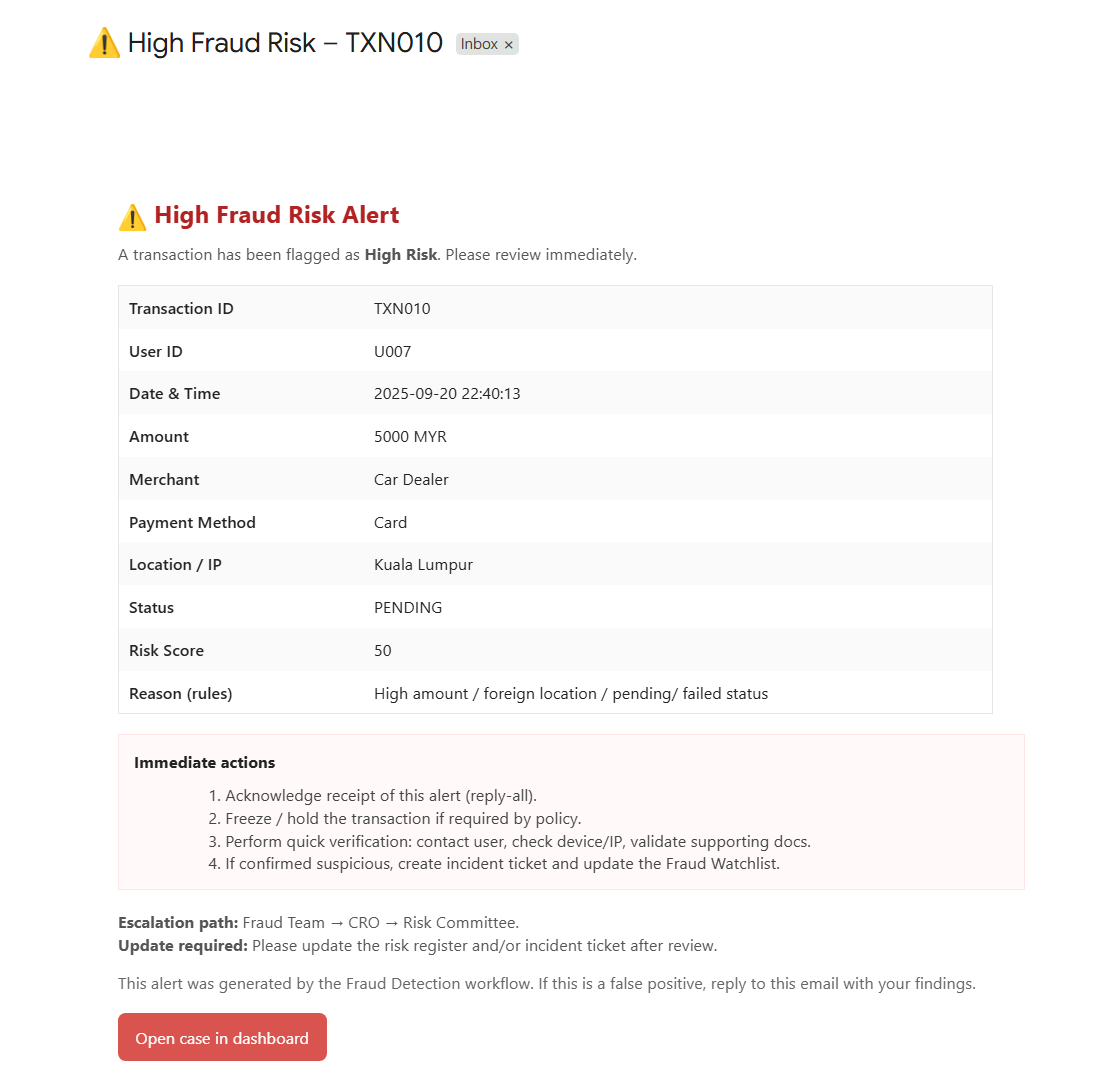

- Send Alerts: For high-risk transactions, an alert email is automatically sent to the risk management team with transaction details and next-step instructions.

Key Benefits

- Early Fraud Detection – Instantly flags risky transactions before they escalate into fraud.

- Zero Manual Work – Automates scoring, categorization, and notifications without human intervention.

- Data-Driven Oversight – Keeps your risk register continuously updated and audit-ready.